Scale your judgment, not your headcount.

You don’t need more analysts. You need a better memory.

We build the centralized brain that remembers every deal, email, and document in your firm’s history—so you can make decisions without digging through your inbox.

Context fragments faster than judgment scales.

Automated Deal Screening

Stop reading bad deals. The system reads term sheets instantly, cross-referencing them against your history. If a deal breaks your rules, it gets flagged before you even open the PDF.

Signal Extraction

Your inbox is a to-do list created by strangers. We fix that. The system kills the noise and highlights the 5% of messages that actually require your judgment—based on urgency, not keywords.

Cross-Entity Retrieval

Stop asking: "Where did I see that clause?" Ask the system in plain English. It pulls the exact document, memo, or email you need from any company in your portfolio, instantly.

Relationship Mapping

Who knows the guy? Stop guessing. We map your firm’s entire email history to show you exactly who on your team has the strongest leverage with a target founder or VC.

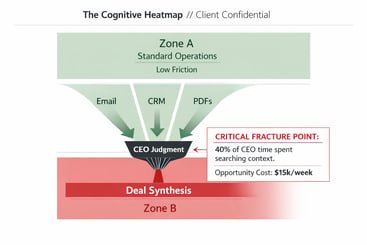

The Bottleneck Audit

We don't start with code; we start with forensics. We audit your current information flow to identify exactly where data fragmentation is breaking your leverage.

The Output:

-

The Data Map: A complete topology of where your institutional knowledge is currently trapped.

-

The Alpha Case: Identification of the single highest-leverage immediate use case (e.g., "Automated Deal Screening" or "Investor Correspondence") where the ROI is obvious and immediate.

Ingestion & Neural Architecture

We deploy the infrastructure. We ingest your historical artifacts, clean the unstructured data, and calibrate the retrieval logic to mimic your specific decision-making heuristics.

The Output:

Your "Company Brain" goes live. It is no longer just a database; it is a system capable of executing complex reasoning tasks with precision, grounded in your firm’s historical data and unique patterns.

Context Compounding & Adaptation

A static brain is a dying brain. As your business grows and the complexity of your portfolio changes, we tune the retrieval logic to match your new reality.

The Output:

The system learns with you. Every deal, decision, and pivot is integrated into the model, ensuring your infrastructure scales its judgment as fast as you scale your capital.

Don’t guess where your leverage is leaking.

The Portfolio Bottleneck Audit is a 2-week diagnostic to identify exactly where your judgment is blocked and how to free it.

Read our Insights

Anatomy of a Bottleneck: What We Find in The Portfolio Bottleneck Audit

"I know I need AI, but I don't know where to start."

We hear this every day from Portfolio Orchestrators. You don't want to hire a massive...

The Privacy Firewall: How We Build a "Company Brain" Without Leaking Your Data

If you are a Portfolio Orchestrator, your competitive advantage isn't your algorithm. It’s your information.Your deal memos, your chaotic email...

The $10M Whisper: Why Standard Due Diligence Misses the Signals that Matter

You are about to sign a term sheet.The background check is clean. The expert network calls were glowing. The P&L looks solid.

But you have a nagging...

The Efficiency Trap: Why "Productivity" AI Is Destroying Your Leverage

The modern Portfolio Orchestrator is not limited by capital. There is plenty of money.You are not limited by deal flow. There are plenty of deals.

...